There has been a lot of attention on Canada’s population growth recently; in a May 2024 Edge Realty Analytics report, there are some insights on potential future growth, as well as the future of supply and demand in real estate.

Metro Population Growth Stats

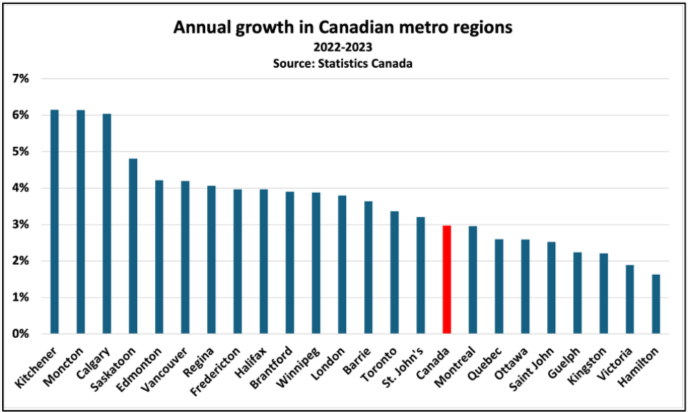

The metro-level population data for 2023 showed a national growth rate of 3%, but with significant regional variations.

Seven major metropolitan areas experienced an unprecedented population growth exceeding 4%. It should be noted that housing stock has historically never increased at a comparable rate.

In particular, Calgary and Edmonton saw growth rates of 6% and 4.2%, respectively, which is helping lead the robust housing market in Alberta. However, Saskatchewan is also of interest. With low supply growth and strong population increases, it may present compelling long-term real estate opportunities. Both Saskatoon and Regina experienced growth above 4% last year. Kitchener led with a 6.1% growth rate, largely due to a substantial increase in international students at Conestoga College, which led the country in international student growth, having expanded enrollment by 12,000 individuals or 1,579% since 2015.

However, this trend of growth due to international students is unlikely to continue. Ontario is facing a 60% reduction in study permit issuance for the 2024 school year, likely bringing Kitchener’s growth back in line with national averages.

Source: Edge Realty Analytics

Source: Edge Realty Analytics

Concerns of Population Surges

The Edge Report further notes that, although concerns about population surges due to immigration, some projections of these surges are based on estimates and linear extrapolations, and may be slightly misleading when considering growth.

Permanent resident growth has remained stable over the past couple of years, with PR admissions even decreasing by 15% year-over-year in March 2024. The acceleration in growth has been coming from the non-permanent resident sector. To sustain this upward trend, continued acceleration in non-permanent residents beyond the 800,000 annual rate observed last quarter would be necessary. However, this rate is unlikely given the federal government’s active efforts to curtail it.

Source: Edge Realty Analytics

Furthermore, although international student admissions surged in Q1 by 51% year-over-year in March, these figures reflect visas approved before the federal government announced a substantial 35% reduction in permits for 2024. When examining new applications, they declined by 15% year-over-year in Q1 and dropped by a significant 53% year-over-year in March alone.

Student applications from India, the leading country of origin for international students dropped by 85% year-over-year in March, reaching their lowest levels since the global lockdown in 2020. As a result, population growth from international students is likely to drop.

Source: Edge Realty Analytics

Source: Edge Realty Analytics

Additionally, temporary worker admissions are also likely to drop. As noted on Indeed Canada, with economic and policy changes, foreign job seekers seem to be losing interest in jobs in Canada. Clicks on Canadian job postings on Indeed from outside of Canada dropped from an average of 14.4% in Q3 2023 to 8.6% in March 2024. With weaker job markets, in addition to the federal government’s announcement of its intention to reduce the number of non-permanent residents by 600,000 over the next three years, this trend is likely to continue.

Building Permits

On the supply side, a critical other aspect for housing, the number of building permits issued in March fell by 4% month-over-month on a seasonally adjusted basis, including a 7% decline in the single-family segment. Even if demand starts to wane with reduced immigration, it is likely a significant supply shortage is developing, particularly in Ontario and British Columbia.