In the first half of 2024, housing construction in Canada’s six largest census metropolitan areas (CMAs) increased by 4% compared to the same period in 2023, mainly driven by significant growth in housing starts in Calgary, Edmonton, and Montréal.

This growth, according to the latest Housing Supply Report (HSR) from Canada Mortgage and Housing Corporation (CMHC), amounted to 68,639 new units, up from 65,905 last year.

Although the overall housing starts in 2024 marked the second-highest level since 1990, the number of starts per 10,000 population in major CMAs remained near historical averages when adjusted for population growth. As a result, the housing supply is still likely to be unable to match rising demographic demand. The regional variation across Canada in key CMAs is another significant aspect of these numbers.

Record Year for Rental Construction

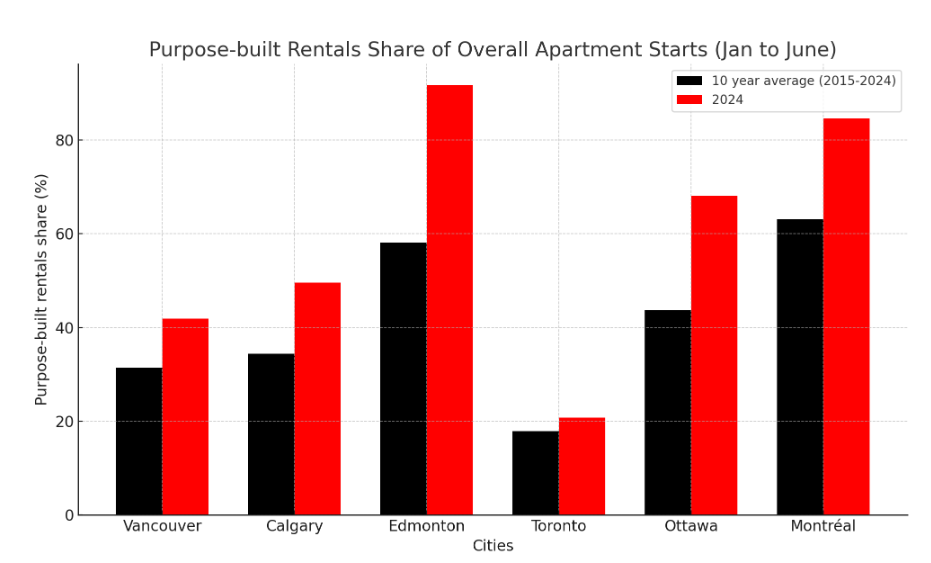

One of the key drivers behind the 4% rise in housing starts in the first half of 2024 was the surge in rental construction, which reached the highest share on record. Of the 49,172 apartment starts across the six CMAs, 47% were purpose-built rentals. This trend marks a pivotal shift in housing priorities, as rental demand has soared due to declining homeownership affordability, tighter mortgage conditions, and shifting demographic preferences.

Source: CHMC

Source: CHMC

Population-Adjusted Housing Starts

A critical metric in assessing housing construction is the number of starts per 10,000 population, as this accounts for the varying population growth rates across cities. When adjusted for population, the overall housing starts across the six CMAs were flat compared to 2023, suggesting that new construction is not keeping pace with demographic demand. This stagnation is especially concerning given the long-standing housing supply gaps in cities like Toronto and Vancouver, where affordability remains a significant issue.

Regional Variations

Edmonton and Calgary Led in Housing Starts

Calgary and Edmonton have emerged as the standout performers in housing construction in 2024, with both cities benefiting from strong economic conditions, affordable housing markets, and record levels of interprovincial migration. Calgary reached its highest level of housing starts on record, while Edmonton saw its second-highest. Housing starts in Calgary grew from 13.7 per 10,000 population in 2023 to 14.5 in 2024, while Edmonton’s figures rose from 10.0 to 19.8 per 10,000 population, the highest among all CMAs.

The CMHA attributes this to Alberta’s economic growth and real GDP per capita outstripping Ontario, Quebec, and British Columbia by about 30%. Additionally, housing in Calgary and Edmonton remains more affordable compared to cities like Toronto and Vancouver, where housing costs relative to incomes are nearly double.

Montréal Recovers

Montréal saw a recovery in housing starts, bouncing back from a 26-year low in 2023 with a 58% rise in new units. Of the 7,192 new rental units started in Montréal—marking a 106% increase—the majority were purpose-built rentals, driven by strong demand in the rental market. While Montréal’s overall housing starts remained below the 10-year average, this rebound reflects a positive shift after years of slower construction.

Declines in Toronto, Vancouver, and Ottawa

Toronto, Vancouver, and Ottawa saw declines in housing starts in 2024, with figures dropping by 10% to 20% in these CMAs. Apartment starts, particularly for condominiums, fell sharply as investors became less willing to commit to pre-construction sales due to rising interest rates, higher financing costs, and softer demand.

Toronto experienced a steep decline in apartment starts per 10,000 population, falling from 30.9 in 2023 to 26.0 in 2024. Similarly, Vancouver saw its apartment starts decrease from 47.6 to 38.0 per 10,000 population over the same period. These declines were partly driven by investors in the condominium market reassessing their strategies as the resale market softened and rental yields fell, making pre-construction units less attractive.

Ottawa saw its apartment starts drop from 17.3 per 10,000 population in 2023 to 10.9 in 2024. Developers in both Ottawa and Toronto faced difficulties meeting pre-construction sales thresholds, leading to delays or cancellations of new projects. High interest rates and declining asking rents in these cities also deterred new investment, further compounding the slowdown in housing starts.