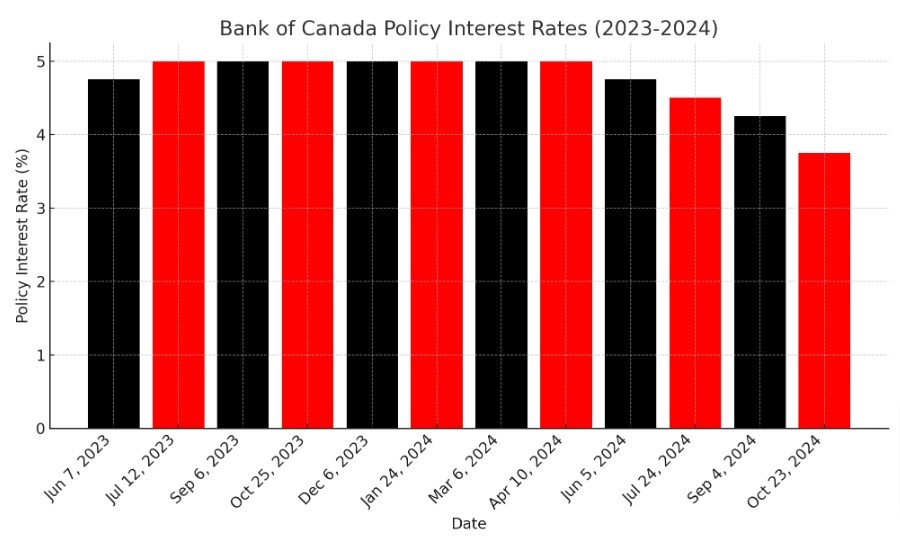

On October 23, 2024, the Bank of Canada cut its key interest rate by 50 basis points, as many experts were predicting, lowering the overnight rate to 3.75%. The Bank Rate now stands at 4%, and the deposit rate matches the overnight rate at 3.75%. This move aims to support economic growth while maintaining inflation close to the Bank’s 2% target.

Source: Bank of Canada

Economic Background for the Announcement

Globally, the Bank expects the economy to grow by about 3% over the next two years. Growth in the U.S. is projected to be stronger than earlier predictions, while China’s outlook remains sluggish. The eurozone is experiencing slow growth but is expected to recover slightly next year. Inflation in advanced economies has eased and now hovers near central bank targets. Global financial conditions have also improved since July, partly due to expectations of lower interest rates. Oil prices have fallen by $10 per barrel since the Bank’s July Monetary Policy Report.

In Canada, the economy grew by 2% in the first half of the year and is expected to slow slightly to 1.75% for the remainder of 2024. While consumer spending has increased, it is declining on a per-person basis. The labour market remains soft, with unemployment at 6.5% in September. Although population growth is expanding the labour force, hiring remains modest, especially affecting young people and newcomers. Wage growth continues to outpace productivity gains, contributing to an economy operating with excess supply.

Looking ahead, GDP growth is expected to strengthen, driven by lower interest rates and increased consumer spending per capita. Residential investment is forecast to rise, fueled by high demand for housing and increased spending on renovations. Business investment is also predicted to pick up, while exports remain strong due to robust U.S. demand. The Bank projects GDP growth of 1.2% for 2024, increasing to 2.1% in 2025 and 2.3% in 2026.

Inflation has dropped significantly, from 2.7% in June to 1.6% in September. Shelter costs, while still high, have started to ease. Global factors such as lower oil prices have reduced inflationary pressures on gasoline, contributing to the overall decline. The Bank’s core inflation measures are now below 2.5%, and inflation expectations among businesses and consumers have largely returned to normal.

Forecast and Future Actions

The Bank expects inflation to stay close to its 2% target in the coming years. While shelter and services continue to exert some upward pressure, this is expected to lessen. As the economy absorbs excess supply, inflationary pressures should remain balanced.

With inflation now near the target, the Bank reduced its policy rate to stimulate economic growth. The Governing Council hinted at the possibility of further rate cuts if the economy evolves as forecast, but any future decisions will depend on new data and its impact on inflation expectations. The next interest rate announcement is scheduled for December 11, 2024, with a full economic outlook to be published on January 29, 2025.