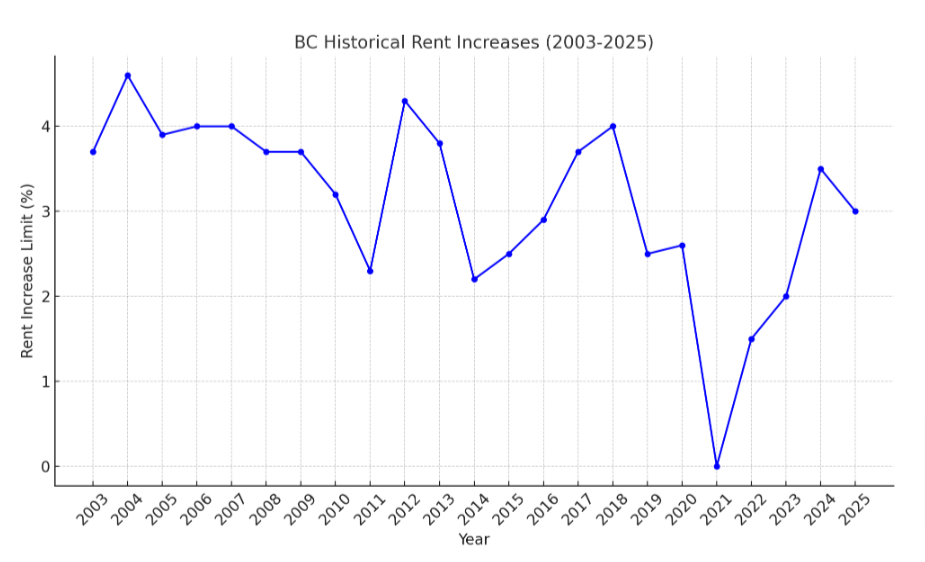

British Columbia’s provincial government has confirmed that the maximum annual allowable rent increase for 2025 will be capped at 3%, a reduction from the 3.5% allowed in 2024. It is tying rent increases to inflation, as calculated using the Consumer Price Index (CPI).

Source: BC Government

Source: Statista Inflation Rates

Next year’s change marks a return to B.C.’s standard formula for rent increases tied to the Consumer Price Index, after several years of rent caps below inflation and freezes during the pandemic.

The maximum allowable rent increase is calculated using the 12-month average change in BC’s all-items CPI for the period ending in July of the year before the increase takes effect. This ensures that rent adjustments are aligned with the broader economic climate. Importantly, landlords cannot round up the rent increase to the nearest whole number; the exact percentage increase must be followed. Furthermore, even if utilities or other services are included in the rent, landlords cannot raise the rent beyond the 3% cap, even if their own costs have increased.

For landlords managing manufactured-home park tenancies, the rent increase for 2025 follows a slightly different formula. While the base increase remains at 3%, landlords can also factor in a proportional amount to account for local government levies and regulated utility fees. This ensures that rent adjustments for these specific tenancies remain fair, considering additional operational costs.

In addition to rent caps, BC landlords are required to adhere to strict rules regarding rent increases and practices.

For rent increases to be lawful, landlords must provide tenants with at least three full months’ notice using the appropriate Notice of Rent Increase form. This legal notice must specify the exact dollar amount of the rent increase and the date it will take effect. The Residential Tenancy Act (RTA) mandates that rent can only be increased once every 12 months, regardless of changes in ownership or tenancy. This rule applies even if a tenancy has been transferred to a new landlord or sublet to another tenant. Any increase beyond the allowable amount is unlawful, and tenants are not required to pay it. If tenants have already paid an illegal rent increase, they are entitled to deduct the overpayment from future rent, provided they explain their reasoning to the landlord in writing.

Landlords cannot retroactively apply rent increases from previous years if they choose not to implement the full allowable amount in those years. This rule prevents cumulative increases that could otherwise impose sudden financial pressure on tenants.

Landlords may ask tenants to agree voluntarily to rent increases above the legal limit, but tenants are under no obligation to accept these terms. If a tenant does agree, the increase must be formalized in writing, outlining the exact dollar amount, the effective date, and any conditions tied to the agreement.

Certain tenancies are exempt from the annual rent increase limit. The 3% cap does not apply to commercial properties, non-profit housing where rent is geared to income, co-operative housing, or some assisted-living facilities. These exemptions recognize the unique regulatory frameworks that govern these types of housing, where rent structures may be based on different criteria.

As a key aspect of managing rent increases, landlords must remain compliant with the Residential Tenancy Act, ensuring that any utilities or services provided under the tenancy agreement are clearly outlined. If landlords wish to raise utility or service fees, they must obtain the tenant’s agreement.