The Bank of Canada released its Q3 2024 Market Participant Survey, which provides valuable insights into the perspectives of approximately 30 financial market participants on various aspects of the Canadian economy.

Conducted from September 18 to 27, 2024, the survey covers expectations for GDP growth, inflation, monetary policy, and financial assets. Organizations actively involved in financial markets, such as investment banks, asset managers, hedge funds, insurers, or pension funds, are polled, for insights from within the industry. Below are some of the key findings from the survey.

Economic Outlook and GDP Growth

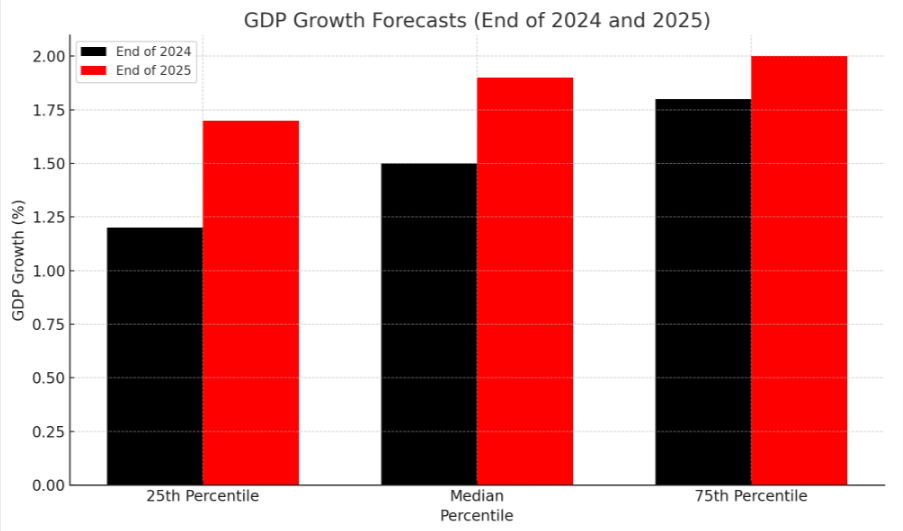

Participants projected moderate growth for the Canadian economy. For the end of 2024, the median year-over-year GDP growth forecast was 1.5%, increasing slightly to 1.9% by the end of 2025. Most respondents believed there was a 54% chance that GDP growth at the end of 2024 would fall within the 1.01% to 2.00% range. The probability of growth above 3.01% was minimal for both 2024 and 2025, reflecting cautious optimism.

Source: BOC

Source: BOC

Upside and Downside Risks

Surveyed participants highlighted that a stronger housing market (75%) and looser monetary policy (71%) were the most significant upside risks to economic growth. On the downside, increased geopolitical risks (50%) and tighter financial conditions (39%) were seen as key challenges.

Source: BOC

Economic Slack and Recession Probability

A large portion of respondents (81.5%) believed that the Canadian economy currently operates below its potential output, signifying a negative output gap. Additionally, the median probability of Canada entering a recession within the next 6 months was estimated at 20%, rising to 25% for the following 6 to 18 months, before slightly moderating over longer periods.

Source: BOC

Inflation Projections

Participants forecasted headline Consumer Price Index (CPI) inflation to be 2.2% at the end of 2024, levelling to 2.0% by 2025. The majority viewed the probability of inflation remaining between 2.01% and 3.00% as the most likely scenario (50% by the end of 2024). Expectations for inflation above 4.01% were minimal, suggesting confidence in inflationary control.

Source: BOC

Monetary Policy and Interest Rates

The median forecast for the Bank of Canada’s policy interest rate indicated a gradual reduction, starting at 4.00% in October 2024, easing to 3.75% by December 2024, and further declining throughout 2025 to reach 2.75% by Q4. A notable 70% of participants perceived the balance of risks as skewed towards a lower path for interest rates.

The Q3 2024 survey reflects cautious expectations for moderate economic growth and controlled inflation. Market participants see potential risks from both domestic and global factors but anticipate a gradual easing of monetary policy as inflation moderates. The results underscore the complex interplay of factors shaping Canada’s economic landscape and the significant attention paid to external risks and policy developments.