British Columbia’s real estate market in Q4 2024 exhibited varied trends across residential, industrial, and office sectors. Residential sales and prices showed notable increases, while industrial and office markets experienced shifts in vacancy rates and new supply.

Residential Summary for Q4 2024

An Edge Realty Analytics report indicates some notable trends in the residential market for British Columbia during this quarter.

Sales

Residential sales in British Columbia increased by 11.5% quarter-over-quarter and by 24.6% year-over-year, reflecting robust buyer demand in the province.

Listings

New listings declined by 1.8% from Q3 2024, although they registered a 6.8% increase on a year-over-year basis. Active listings grew by 2.6% quarter-over-quarter and by 19.1% year-over-year, providing a broader selection for prospective buyers.

Prices

Home prices increased by 0.7% compared to the previous quarter, while showing a slight year-over-year decrease of 0.1%, indicating a balanced pricing environment.

Under Construction

Housing units under construction decreased by 0.8% quarter-over-quarter, but experienced a 4.1% increase on a year-over-year basis.

Months of Inventory

The months of inventory, representing the time it would take to sell all current listings at the current sales pace, decreased from 5.9 months in Q3 2024 to 5.5 months in Q4 2024.

Sales-to-New Listings Ratio

The ratio of sales to new listings improved from 44.6% in Q3 2024 to 50.6% in Q4 2024, reflecting increased market absorption.

Economic Indicators

British Columbia’s population grew by 0.4% quarter-over-quarter and 2.2% year-over-year. The unemployment rate remained at 5.8% in Q4 2024, and mortgage arrears saw a modest rise from 0.16% to 0.17%.

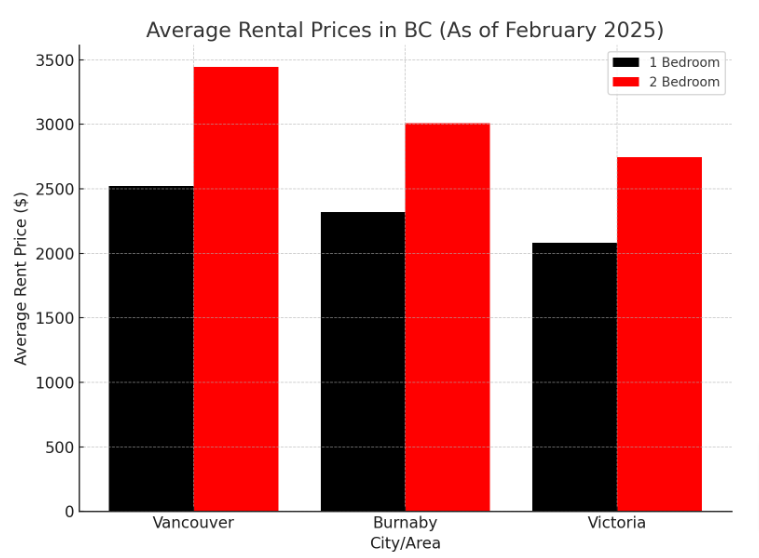

Rental Market for Q4 2024

Source: Rentals.ca

Industrial Summary for Q4 2024

Vancouver Industrial Market

According to CBRE, the industrial sector in Metro Vancouver delivered nearly 1.9 million square feet of new industrial space in Q4 2024. However, only 33.2% of this new supply entered the market with pre-commitment agreements. The availability rate increased by 100 basis points to 3.8%, while overall market availability expanded by 120 basis points to 5.3%.

The sector recorded a net negative absorption of 848,000 square feet, for the first contraction in space absorption since the Global Financial Crisis. Average asking lease rates fell by 60 basis points to $20.09 per square foot, although these rates remain above the five-year average of $18.20.

Office Summary for Q4 2024

Vancouver Office Market

The overall office vacancy rate increased by 30 basis points to 11.2%; however, Metro Vancouver’s office market in Q4 2024 revealed divergent trends between submarkets.

In suburban areas, vacancy rates rose by 80 basis points to 10.8%, while the downtown core experienced a decline of 30 basis points, settling at 11.5%. Downtown leasing activity was robust, with nearly 550,000 square feet of gross leasing and a net absorption of 76,000 square feet recorded during the quarter. Average asking lease rates in downtown areas declined by 3.8% on an annual basis to $37.20 per square foot, whereas suburban rates increased by 7.2% to $29.47 per square foot.

With 91.2% of new downtown office supply already absorbed and only one competitive project expected to come online by late 2025, the construction cycle in the downtown core appears to be drawing to a close. In contrast, an additional 553,000 square feet of new office supply is anticipated in suburban markets over the next 12 months.

Notably, more than 70% of head lease deals over 5,000 square feet now include lease terms of five years or longer, highlighting a shift toward long-term tenancy amid market uncertainty.