Last Updated on November 26, 2024 by CREW Editorial

Calgary’s evolving real estate market offers significant potential for investors seeking to build long-term wealth through multi-unit property investments. The city’s economic strength, demographic growth, and strategic urban planning create excellent opportunities for multi-unit residential investments.

For those looking to expand their portfolio into Calgary’s lucrative multi-unit property market, it is important to conduct thorough research. It can be challenging to sift through the opportunities to identify the best options that meet your personal investment needs and goals, but a top Calgary realtor who specializes in investment properties, such as Jesse Davies, leader of the Jesse Davies Team with Century 21, can simplify the search and ensure you are well-informed.

Calgary’s Real Estate and Rental Market

Calgary’s real estate market in 2024 continues to be shaped by several intersecting trends. The city has experienced sustained population growth, rising a notable 6.2% year-over-year in 2023.

The housing inventory in Calgary has been significantly strained, with available listings in August 2024 sitting at 25% lower than historical averages for the month.

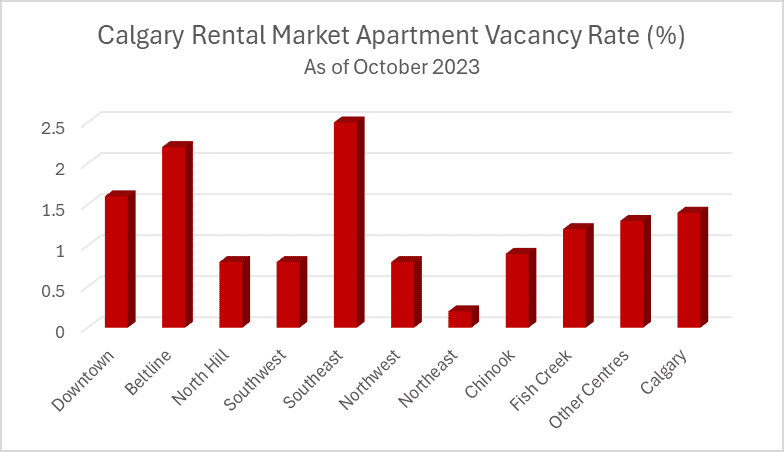

Jesse Davies notes, “The rental market mirrors the tight supply seen in the housing market. The current competitive environment is driven by limited options for both buyers and renters, pushing demand and prices higher across the board. This is leading to low vacancy rates for rental apartments and strong rents, which translate to more secure and consistent income for landlords.”

Source: CMHC

Now is potentially an excellent time to investigate multi-unit investments in Calgary, as the City is in a phase of encouraging higher-density housing. Initiatives like the Office Conversion program, with incentives like the Plus 15 Fund Offset Program aimed at encouraging residential development, may lead to exciting new options, in addition to existing, lucrative ones.

The Multi-Unit Investment Advantage in Calgary

Investing in multi-unit properties in Calgary offers several key advantages over single-family homes or smaller rental properties.

Economic Resilience and Return Potential

Multi-unit residential investments can generate higher total returns through a combination of rental income, property appreciation, and operational efficiencies.

Davies remarks that “Calgary multi-unit properties tend to have good cap rates, indicating a stable income stream. This, combined with the fact that Alberta doesn’t limit rent increases, means the potential rental income is strong. This makes for excellent wealth-building opportunities”

Owning multi-unit properties, including multiplexes and apartment buildings, helps spread out maintenance and management costs across multiple units, increasing operational efficiency and profit margins. The negative impact of a vacancy is also balanced out by the other units that are filled.

Favourable Demographics and Tenant Demand

Calgary’s growth trajectory, driven by job creation in sectors such as technology, energy, and professional services, attracts a diverse tenant pool. Young professionals and families who are priced out of home ownership but prefer city living make up a significant portion of the renter demographic. Overall, a sustained demand contributes to reliable cash flow from rentals.

Identifying Ideal Multi-Unit Investment Properties: Strategic Approaches to Searching for Properties to Build Wealth

When searching for multi-unit properties, the goal is not simply to buy a building but to make a strategic acquisition that will yield long-term returns, build wealth, and align with the investor’s broader financial objectives. Understanding the nuances of Calgary’s real estate market, and targeting specific property features can significantly improve the chances of securing a profitable investment, so leveraging the expertise of a seasoned realtor can provide a significant advantage.

Diversify Across Neighbourhoods for Growth and Stability

To build a resilient multi-unit property portfolio, diversify investments across different Calgary neighbourhoods. This strategy helps mitigate risks that come with overexposure to a single market segment and positions an investor to capitalize on different types of rental demand.

Local real estate expert Davies suggests taking this strategy a step further, and recommends that “Investors should diversify not only by neighbourhood but also across tenant demographics to achieve maximum stability.”

Davies also gives some examples. The multi-unit properties in Beltline or Mission can cater well to young professionals due to their proximity to Calgary’s downtown business district, restaurants, and nightlife. On the other hand, suburban areas like Panorama Hills or Tuscany, known for their family-friendly environments and excellent schools, can be ideal for larger units appealing to families seeking a quieter, more residential atmosphere. Neighbourhoods like Bridgeland, undergoing revitalization and known for a mix of cultural amenities and green spaces, often appeal to young families and mid-career professionals, so a blend of units that cater to these groups can be successful.

Look for Growth Corridors

Consider emerging neighbourhoods that have future growth potential. Suburbs or areas undergoing revitalization projects may offer more affordable properties with higher upside potential. Davies suggests the East Village and Ogden neighbourhoods, as they have seen significant development activity and could offer higher returns for long-term investors.

Assess Local Amenities and Infrastructure Projects

Proximity to amenities such as schools, parks, transit lines, and major employers can make a property more attractive to tenants. Calgary’s planned Green Line or other developments can directly impact the value of multi-unit buildings located near these developments. A realtor who is knowledgeable about upcoming city plans and zoning changes can help you identify affordable neighbourhoods with favourable long-term prospects, while avoiding areas that are over-saturated or where growth is unlikely.

Follow Economic Indicators to Identify High-Demand Areas

Economic indicators like job growth, population increases, and business investments are often linked with higher rental demand. Multi-unit properties in economically expanding areas or near major employment hubs typically see better tenant occupancy and steadier rent increases. Areas with active real estate development and new construction often present strong growth opportunities, too. A knowledgeable realtor can provide access to city-approved development plans and other resources to reveal neighbourhoods with the greatest investment potential.

Evaluate Property Condition and Potential for Improvement

When searching for multi-unit properties, it’s critical to assess not just the current condition of the building but also its potential for improvements that could increase rental income or property value.

While cosmetic upgrades like painting and flooring can add value, larger structural issues—such as the foundation, roof, or plumbing—can be costly. Ensuring a thorough inspection is essential to assess any hidden problems that might become financial burdens.

A skilled realtor can help identify properties with hidden potential where targeted, cost-effective upgrades can yield strong returns, and warn you if significant, foundational work is required. Such a property could still be profitable, but the investment needs to be approached carefully.

Understand the Legal and Regulatory Environment

Navigating the legal aspects of multi-unit property ownership is crucial to avoiding costly mistakes. Zoning regulations, building codes, and rent control laws all play significant roles in determining what you can and cannot do with your multi-unit property. An investment realtor can guide you on current restrictions, future potential, and other aspects that impact a potential property’s profitability; professional legal advice is also recommended to ensure compliance.

Determine the Right Tenant Demographics for a Property

The ability to attract and retain quality tenants is a key factor in maximizing returns from multi-unit investments. Determining the target tenants for a potential multi-unit property to invest in ensures you are prepared for what will be involved in attracting and retaining tenants, and that the property will fit your investment goals.

Tenant profile diversification, or catering to a wide range of potential tenants, can help ensure consistent income. Factors such as proximity to public transport, schools, or major employers all influence who is interested in your property; a wide variety of amenities will draw multiple demographic types. Similarly, a property with a mix of unit sizes can attract varied singles, couples, and families.

Again, an experienced realtor can offer insights into which tenant profiles are most common in specific neighbourhoods, as well as how to tailor a property to meet these demands.

Financing

Favourable financing reduces expenses, allowing for more money to go towards wealth building. Multi-unit requires strategies beyond a simple conventional residential mortgage, however.

Commercial loans tailored for income-generating properties provide flexibility with loan-to-value ratios and interest rate structures, making them a valuable tool for wealth building. Traditional commercial loans are commonly used to fund multi-unit investments, but alternative financing options like private loans can offer faster access to capital and additional flexibility. To further expand their portfolios, investors can also leverage partnerships and joint ventures, pooling resources to increase purchasing power, to enable the acquisition of larger, higher-yield properties. Thorough research and consulting with a mortgage broker experienced in multi-unit properties is recommended to get the most favourable financing.

Strategies for Multi-Unit Investments

Value-Added Investment Strategies

A value-added approach, which focuses on acquiring properties that require renovation or operational improvements, can significantly enhance both rental income and property value. Properties can be obtained at a competitive price, while strategic improvements can be done cost-effectively, for an excellent overall return on investment (ROI).

Value-added strategies go beyond basic renovations and aim to improve both property appeal and income potential. Targeted upgrades like modernizing unit interiors, installing energy-efficient appliances, or adding sought-after amenities such as on-site gyms or laundry facilities are best for increasing ROI. The addition of eco-friendly features, like solar panels or water-saving systems, not only attracts environmentally conscious tenants but can also qualify for local energy incentives, improving the investment’s bottom line.

Operational improvements, such as incorporating smart property management technologies and re-evaluating leasing practices to include rent escalations tied to market trends, also help increase income and asset value.

Market Diversification

Expanding investment into different neighbourhoods or cities can significantly mitigate localized market risk and offer better stability. This ensures downturns or unexpected events in one market do not critically impact an investor’s entire portfolio. By selecting regions with varying economic drivers—such as university towns, suburban growth areas, or urban centers with revitalization plans—investors can capture the benefits of diverse rental demand and property appreciation rates. Market diversification enables a broader reach into emerging or resilient areas that might have better potential during different economic cycles.

Tenant Profile Diversification

Tailoring multi-unit properties to attract a diverse tenant base is another powerful strategy for income stability. Rather than focusing solely on one tenant type, such as students or young professionals, investors can create varied units or amenities that appeal to different demographics. This can include designing family-friendly units with additional space and playground areas or catering to retirees with accessibility features. Diversifying the tenant profile helps reduce vacancy risks by ensuring a broader appeal and smoother transitions during tenant turnover, as the property remains attractive to different life stages and needs.

Future Outlook

As Calgary’s population continues to grow, driven by economic expansion and quality of life, demand for rental housing is likely to remain robust. Multi-unit properties present a resilient investment model, balancing cash flow stability and capital appreciation. The city’s development plans promise to elevate property values in well-connected neighbourhoods. Overall, investing in Calgary’s multi-unit real estate market offers both immediate and long-term financial benefits.

For optimal results, the right properties need to be selected, however. Working with an experienced Calgary investment realtor like Jesse Davies can be a critical advantage for investors navigating the complexities of multi-unit property acquisitions. This expertise helps identify high-potential properties that provide a solid foundation for wealth building.