Ottawa, November 29, 2024 – The Canada Mortgage and Housing Corporation (CMHC) has released its financial results for the third quarter of 2024, revealing a sustained increase in demand for multi-unit insurance products, driven largely by the continued success of its MLI Select program.

As Canada’s sole provider of mortgage loan insurance for multi-unit residential properties, CMHC facilitates access to lower borrowing costs and preferred interest rates for construction, purchase, refinance, and mortgage renewals. These efforts form a core part of CMHC’s broader mandate, which also includes delivering housing programs on behalf of the federal government.

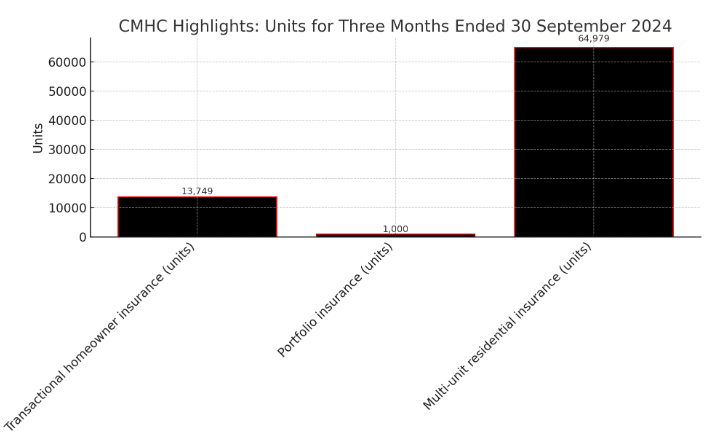

For the three months ending September 30, 2024, CMHC insured 64,979 multi-unit residential units, marking a 26% increase from the 51,443 units insured during the same period in 2023. Of these, 29,878 were newly constructed units. Over the first nine months of 2024, CMHC insured a total of 206,157 multi-unit residential units, compared to 156,419 units during the same period in 2023, reflecting a 32% rise.

The total insured volume for the first three quarters of 2024 amounted to $47.6 billion, a 59% increase from $29.9 billion in the corresponding period last year. This growth underscores CMHC’s pivotal role in supporting the development of Canada’s rental housing stock, offering solutions that promote affordability and accessibility while integrating features for climate compatibility.

Expanded Support for Affordable Housing

As part of its broader housing initiatives, CMHC launched the Co-Op Housing Development Program (CHDP) during Q3. This program is designed to support the construction of affordable rental co-operative housing units, with a budget of $1.5 billion in loans. The program aims to fund up to 100% of eligible residential project costs and 75% of non-residential project costs, addressing affordability challenges across the country.

Michel Tremblay, Chief Financial Officer and Senior Vice-President of Corporate Services, highlighted the importance of CMHC’s efforts in tackling housing supply issues. “Facilitating the construction of purpose-built rentals remains a key factor in addressing the country’s housing supply and affordability challenges. We are pleased to see such consistent and increasing uptake in our multi-unit insurance products, which are an important factor in supporting the creation of rental supply in Canada.”

Key Financial and Operational Metrics

CMHC’s Q3 report also provided updates on capital management and the health of its mortgage insurance portfolio as of September 30, 2024:

Mortgage insurance capital: $11.2 billion

Capital available to minimum capital required: 191%

Insurance-in-force: $431 billion

Guarantees-in-force: $539 billion

Canadian residential mortgages with CMHC insurance: 19.5%

National mortgage arrears rate: 0.30%

Source: CMHC