Mortgage trends and other household debts continue to raise concerns. According to an Edge Realty Analytics June 2024 report, first-quarter decreases in Canada’s household debt service ratio due to static payment variable rate mortgages could lead to increased financial pressure when these loans renew, while rising household interest payments and a high debt-to-GDP ratio are squeezing discretionary spending, potentially slowing economic growth.

High debt levels and rising servicing costs can constrain consumer spending and economic growth. As interest rates continue to rise, the financial stability of households and the broader economy

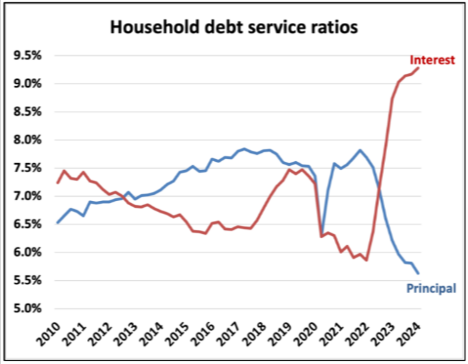

In the first quarter of 2024, the household debt service ratio in Canada saw a slight decrease, ticking down by 7 basis points (bps). This was somewhat unexpected given the rising interest rate environment. The decline was primarily driven by an 18 bps reduction in the principal repayment component of the ratio, even as the interest paid component increased by 11 bps.

Source: Edge Realty Analytics

Impact of Static Payment Variable Rate Mortgages

A significant factor behind the lower principal repayment could be the prevalence of static payment variable rate mortgages. These mortgages maintain constant payment amounts by extending the amortization period as interest rates rise. However, when these loans reach their renewal period, they must revert to the original amortization schedule, which could put upward pressure on principal repayments in the coming years, particularly in 2025 and 2026.

Rising Interest Payments and Household Spending

Household interest payments have surged dramatically, reaching an annualized $170 billion in Q1, up from $90 billion just two years ago. This increase in debt servicing costs significantly reduces the amount of money available for discretionary spending, potentially dampening economic activity.

Household Debt Relative to GDP

Although the household debt-to-GDP ratio slightly declined to 101.6% in Q1 from 102.2% in the previous quarter, it remains concerningly high. This ratio is still well above the peak level observed in the United States in 2009, positioning Canada among the highest in terms of household indebtedness globally.

Canada is near the top among major economies regarding total non-financial debt relative to GDP, which includes household, corporate, and government debt. This high level of indebtedness means that the impact of rising interest rates is felt more acutely in the Canadian economy compared to others. Recent data from the Bank for International Settlements (BIS) places Canada firmly in the top ranks of indebted countries, underscoring the vulnerability of the Canadian economy to interest rate hikes.

Source: Edge Realty Analytics

Source: Edge Realty Analytics

Rising Mortgage Arrears

The latest data from the Bank of Canada highlights a continued increase in mortgage arrears and credit card delinquencies as of the first quarter, though auto loan arrears have decreased. The financial stress is not evenly distributed across Canada. Ontario, British Columbia, and Quebec have experienced above-average increases in consumers missing credit payments, with severe delinquency in mortgage balances exceeding $1 billion in Ontario for the first time.

In these provinces, the high costs of home ownership and rent are significant contributors to financial strain. Despite these pressures, mortgage arrears at the national level remain relatively low, reported at 19 basis points (bps), with Ontario and British Columbia at 13 bps and 15 bps, respectively, according to the Canadian Bankers Association.