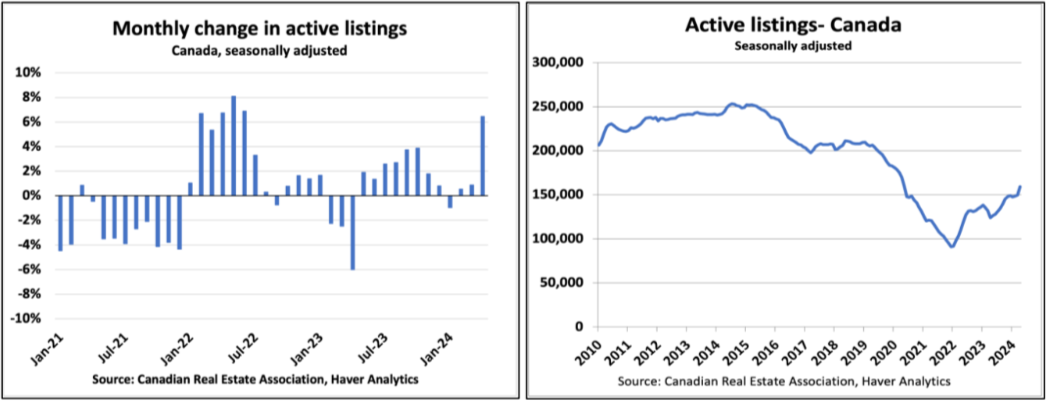

A May 2024 Edge Realty Analytics report has highlighted some concerns about inventory surges in Canada this April. The latest housing data reveals a notable surge in resale inventory across Canada, signalling a significant shift in market dynamics.

In April, the seasonally adjusted active listings rose by 6.5% month-over-month (m/m), marking the largest monthly increase since June 2022. This surge is primarily attributed to Ontario, where inventory levels soared by 16% m/m, pushing the year-over-year (y/y) increase to a remarkable 58%. For comparison, the national y/y increase in inventory stands at 29%.

Regional Variations in Inventory Levels

However, different regions of Canada exhibited varying trends in their inventory levels:

British Columbia (BC): Active listings increased by 6.4% m/m in April. This is indicative of a substantial rise in the availability of properties compared to previous months.

Quebec (QC): Inventory also rose by 2.7% m/m in April, contributing to a broader trend of increasing supply in the province.

Alberta (AB): In contrast, Alberta experienced a decline in active listings, reaching the lowest levels seen in two decades. This drop is significantly different from the trends in other areas.

New Listings

The housing market saw a significant influx of new listings in April. Seasonally adjusted new listings rose by 2.8% month-over-month (m/m), the most substantial monthly increase since September of last year. On a year-over-year (y/y) basis, new listings surged by 35%.

In non-seasonally adjusted terms, April experienced the strongest month for new listings since June 2022. This uptick follows a notable shortage of listings over the past year. Typically, the market experiences a degree of “churn,” where the supply of new listings fluctuates around a mean level, often overcorrecting in response to previous shortages. Given the current dynamics, the Edge Realty Report predicts that this pent-up selling pressure will keep new listings at higher levels throughout the rest of the year.

The report attributed a significant portion of this recent rise in new listings to an increase in completions of residential properties – specifically homeowner completions – which showed a marked increase in the availability of condos and single-family homes. This trend is likely to continue, driven by the number of homes still under construction.

Source: Edge Realty Analytics

Source: Edge Realty Analytics from CMHC Numbers

Sales

In April, seasonally adjusted home sales dropped by 1.7% month-over-month (m/m), reflecting a broader weakening in the market. This decline was most pronounced in Ontario, where sales volumes decreased by 2.9% m/m. Over the past three months, Ontario has seen a cumulative drop of 12% in sales volumes.

Despite some experts being optimistic about a robust spring market, these actual figures are not positive, especially during the spring which is typically such a crucial period for the market’s momentum for the rest of the year.

With this increase in supply and a decrease in demand, the balance in the housing market is shifting. The number of months of inventory, which indicates how long it would take to sell the current inventory at the current sales pace, has climbed to its highest level nationally since 2020.

Prices

The MLSⓇ House Price Index (HPI) remained steady in April. However, due to the three- to six-month lag in how price movements reflect market conditions, there is a strong possibility of renewed downward pressure on prices this summer if the current trends, including increased inventory, persist without significant changes.

Regional data revealed varying trends across the country, however. Many of the major metropolitan areas in Ontario had a positive price momentum in April, while in contrast, BC saw a drop in prices last month.

Nationally, house prices are still 13% below their peak levels. Some metropolitan areas in Ontario have seen even more dramatic declines, with prices down over 20% from their peaks and, in real terms, accounting for inflation, down by more than 30%. This indicates a significant downturn and a historic adjustment period for certain regions.

Source: Edge Realty Analytics

Summary of April 2024 Key Housing Data