The Office of the Superintendent of Financial Institutions (OSFI) has recently published its Annual Risk Outlook for 2024, which included some noteworthy insights.

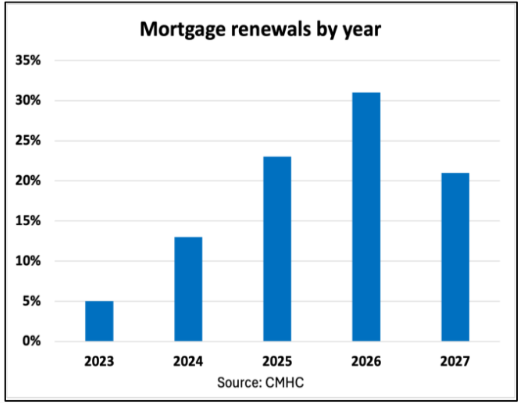

OSFI projects that by the end of 2026, 76% of the existing mortgage loans as of February 2024 will come up for renewal. This high volume of renewals poses a significant risk to Canadian homeowners, especially those who secured mortgages at lower interest rates during the period from 2020 to 2022.

Homeowners renewing their mortgages in the next few years could face a substantial increase in their monthly payments. This “payment shock” arises as they transition from historically low rates to potentially higher current rates, which could strain household finances.

Households that are highly leveraged and have borrowed a significant portion of their home’s value will feel the brunt of these rising costs more severely. This is particularly true for those with variable-rate mortgages that have fixed payments, where the interest portion of their payment may increase significantly.

As these borrowers adjust to higher rates, there is an anticipated rise in the number of residential mortgage loans entering arrears or default, as some homeowners may struggle to keep up with increased payments.

OSFI’s forecast aligns closely with the Canada Mortgage and Housing Corporation’s (CMHC) estimates, which also indicate that approximately 70% of outstanding mortgages are expected to come up for renewal between 2024 and 2026.

Some of the mortgage renewals will involve short-term loans lasting one to two years, which means these borrowers have already experienced payment increases during the current cycle of interest rate hikes. However, according to an Edge Realty Analytics May 2024 report, nearly 60% of borrowers have yet to see their payments reset during this cycle.

OSFI’s Annual Risk Outlook also reveals that mortgages which have already undergone payment increases due to renewal or specific product types, such as adjustable-rate mortgages, are exhibiting higher rates of non-performance, or the frequency or proportion of mortgage loans that are not meeting their contractual obligations. If residential real estate markets weaken, this trend could escalate into increased defaults, lowered recovery rates, and consequently, higher credit losses for financial institutions.

Variable-rate mortgages with fixed payments constitute approximately 15% of Canada’s outstanding residential mortgages. Should mortgage rates stay high, borrowers may face significant financial strain in meeting their contractual amortization obligations, and struggle to make necessary lump sum payments or increased mortgage payments.

Static payment variable rate loans appear particularly vulnerable. Median payments for these loans are projected to reset 50% to 60% higher in 2025 and 2026.

However, the Edge Realty Analytics report challenges OSFI’s estimate that mortgages with variable rates and fixed payments represent only 15% of all outstanding mortgages. To provide a clearer picture, the report draws on various data sources and industry insights:

The Bank of Canada publishes detailed data on mortgage loan balances categorized by product type. According to their figures, variable-rate mortgages account for 28% of all outstanding mortgages, which is significantly higher than OSFI’s 15% estimate for variable-rate mortgages with fixed payments.

The two primary chartered banks providing floating payment variable rate loans are the Bank of Nova Scotia (BNS) and the National Bank of Canada. Together, these banks represent just over 20% of the domestic mortgage loans issued by chartered banks.

The remaining major banks predominantly offer static payment variable rate loans. When considering the total market, these banks account for approximately 23% of the variable rate mortgage market share. This discrepancy suggests that the proportion of static payment products is higher than OSFI’s estimate.

While some households might choose mortgages with floating payments (where monthly payments vary with interest rate changes), discussions with mortgage professionals indicate that this is a very small segment. The demand for floating payment products is minimal, and insufficient to explain the difference in OSFI’s lower market share estimate of 15%.

Based on these insights, Edge Realty Analytics proposes a revised breakdown of the mortgage market:

Fixed 5-Year Mortgages: 37%

Fixed 3 to 4-Year Mortgages: 24%

Variable-Rate Mortgages with Fixed Payments: 22%

Fixed 1 to 2-Year Mortgages: 11%

Variable-Rate Mortgages with Floating Payments: 6%

OSFI’s Annual Risk Outlook also notably highlights ongoing concerns in corporate credit and commercial real estate, with particular focus on the construction and development and office sectors. These areas remain under stress and face significant uncertainty. Despite the availability of market-based and core funding liquidity, past economic downturns and stress events have shown that such conditions can rapidly deteriorate.

The construction and development sector, in particular, is struggling due to high interest rates and issues with affordability. Since 2020, banks have substantially increased their loans to construction and development projects, amplifying their exposure to potential risks in these markets.