Ontario’s real estate market in Q3 2024 revealed varied performance across its residential, rental, and office sectors. Residential sales and active listings rose, while prices fell slightly. The rental market exhibited notable variations in rent trends. Office vacancy rates demonstrated both recovery and ongoing challenges depending on the region.

Residential Summary for Q3 2024

According to an Edge Realty report, there have been some interesting trends in the residential market.

Sales

Residential sales in Ontario rose by 2.9% quarter-over-quarter and 8.2% year-over-year.

Listings

New listings increased by 6.1% from Q2 and 7.2% year-over-year, while active listings grew significantly by 2.2% quarter-over-quarter and 27.8% year-over-year.

Prices

The average home price in Ontario experienced a modest decline of 0.3% from Q2 and a more pronounced drop of 4.4% year-over-year.

Months of Inventory

Ontario’s months of inventory, or how long it would take to sell all current listings at the current sales pace, held steady at 3.9 months from Q2 to Q3.

Sales-to-New Listings Ratio

The sales-to-new listings ratio dropped from 43.4% in Q2 to 42.1% in Q3.

Construction Activity

Under-construction residential projects decreased slightly by 0.1% quarter-over-quarter and by 6.0% year-over-year.

Economic Indicators

Ontario’s population grew by 0.6% quarter-over-quarter and by 3.2% year-over-year, contributing to housing demand.

The unemployment rate improved marginally, declining from 7.0% in Q2 to 6.9% in Q3. However, despite this drop, Ontario’s unemployment rate was higher than Canada’s overall rate of 6.5% in October.

Also concerning is that mortgage arrears rose slightly to 0.16% from 0.13% in Q2, signalling some financial strain among homeowners.

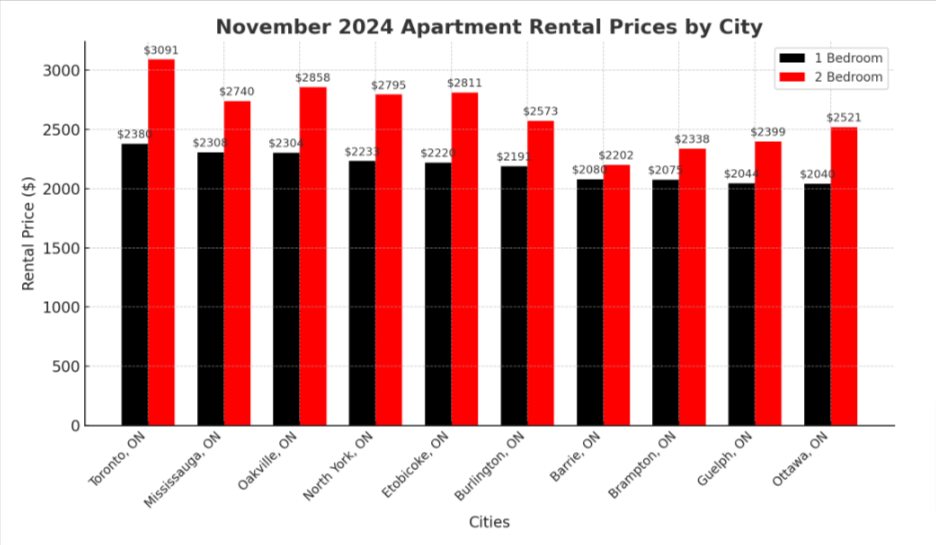

Rental Market for November 2024

Source: Rentals.ca

Source: Rentals.ca

Ontario Office Market Trends – Q3 2024

Toronto

According to the CBRE, the suburban Greater Toronto Area (GTA) office market recorded its first quarter of positive net absorption in 2024, with 307,000 square feet absorbed, the largest gain since Q3 2022. The vacancy rate dropped by 50 basis points to 20.7%, primarily driven by leasing demand for Class A and B spaces in the western suburbs. Sublet vacancies also declined to 17.9%, significantly below the post-pandemic high of 24.4% in 2021.

Downtown Toronto saw positive net absorption for the second consecutive quarter, totalling 408,000 square feet, although the vacancy rate edged up by 10 basis points to 10.6%. This increase was linked to the delivery of nearly 600,000 square feet of partially vacant new developments. Leasing activity remained strong, with 621,000 square feet transacted, concentrated in the Financial Core and Greater Core. Weighted average net asking rents held steady at $34.26 per square foot, while tenant inducements, particularly for base-build spaces in fringe areas, stayed significant.

Waterloo Region

The Waterloo Region continued its positive momentum, recording nearly 40,000 square feet of net absorption year-to-date. Leasing activity was driven by Class A turnkey spaces, while older, shell-condition offices struggled to find tenants. Coworking spaces expanded, adding 80,000 square feet since 2023, with further growth expected by 2025.

London

London’s downtown core vacancy rate hit a record high, with nearly one-third of office space now vacant. However, no significant new vacancies are anticipated in the near term. Suburban office spaces are performing better, with most vacancies involving smaller units under 9,200 square feet. A government entity is exploring the potential conversion of vacant downtown offices, such as 120 Queens Ave, into residential units, although no concrete plans have been announced.

Ottawa

Ottawa’s office market posted mixed results. Overall vacancy rose to 12.2%, up from 11.9% in Q2, with a negative net absorption of 124,000 square feet. The Central Business District was particularly affected, with vacancies increasing to 13.1% due to future-dated listings in buildings like 180 Kent Street and 160 Elgin Street. Kanata performed better, recording positive net absorption of 18,000 square feet and lowering its vacancy rate to 12.1%. Future market dynamics may be influenced by the federal government’s plan to repurpose 22 properties, including some in Ottawa, into affordable housing.