Quebec’s real estate market in Q3 2024 reflected ongoing trends across residential, rental, industrial, and office sectors. Residential sales and prices sustained their upward momentum, while industrial and office markets experienced ongoing challenges.

Residential Summary for Q3 2024

An Edge Realty Analytics report indicates some notable trends in the residential market for Quebec.

Sales

Residential sales in Quebec increased by 5.9% quarter-over-quarter, with an 18.6% year-over-year rise, reflecting sustained activity in the housing market.

Listings

New listings rose by 0.6% from Q2 2024 and 9.7% year-over-year. Active listings showed smaller growth, up 0.5% quarter-over-quarter and 17.1% year-over-year.

Prices

Home prices grew by 2.9% compared to the previous quarter and 5.7% year-over-year.

Months of Inventory

The months of inventory, which is the length of time it would take to sell all current listings at the current sales pace, decreased to 4.8 months in Q3, down from 5.2 months in Q2.

Sales-to-New Listings Ratio

The sales-to-new listings ratio rose from 63.7% in Q2 2024 to 67.0% in Q3.

Construction Activity

Under-construction housing units decreased by 9.7% quarter-over-quarter and 8.2% year-over-year.

Economic Indicators

Quebec’s population grew by 0.6% quarter-over-quarter and 2.4% year-over-year, while the unemployment rate declined from 5.7% in Q2 to 5.5% in Q3. This is lower than Canada’s overall unemployment rate of 6.5% in October, for reference.

Mortgage arrears saw a slight increase, rising from 0.16% to 0.17% quarter-over-quarter.

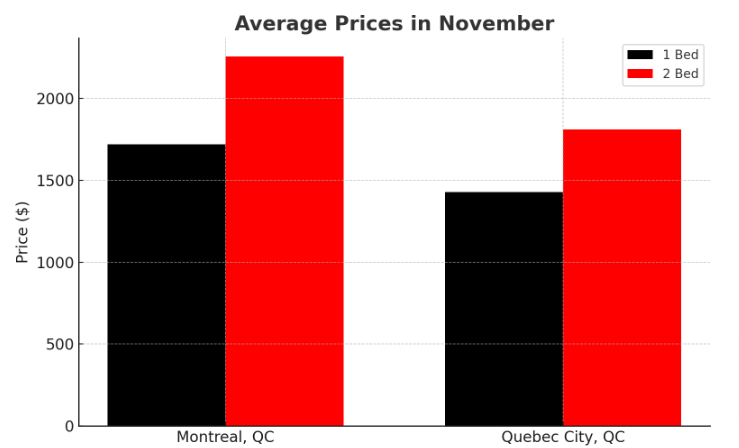

Rental Market for November 2024

Source: Rentals.ca

Source: Rentals.ca

Industrial Summary for Q3 2024

Quebec City Industrial Market

According to the CBRE, the availability rate in the Greater Quebec Area increased by 80 basis points, reaching 4.6%. Sublet space expanded to 61,442 square feet, with notable availability at 2665 Dalton Avenue. Net asking rental rates fell 4.0% quarter-over-quarter. A total of 300,000 square feet of industrial space was sold.

Montreal Industrial Market

The Greater Montreal Area (GMA) saw its availability rate climb by 210 basis points year-over-year to 4.5%, marking a five-year high. Net rental rates declined by 2.2% in Q3, continuing a five-quarter downward trend.

Approximately 1.3 million square feet of new industrial supply entered the market in areas such as Saint-Bruno-de-Montarville, the East End, and the West Island. Speculative construction declined by 31.2% quarter-over-quarter.

Office Summary for Q3 2024

Quebec City Office Market

The office vacancy rate in the Greater Quebec Area (GQA) rose by 40 basis points quarter-over-quarter, reaching its highest level in a decade. Net absorption remained negative but slowed compared to Q2. Rental rates stabilized at 2023 levels, with no significant quarter-over-quarter or year-over-year changes.

Montreal Office Markets

In Montreal, vacancy rates increased across most submarkets. Class AAA buildings reported a 7.7% vacancy rate, while Class B spaces in Downtown South saw a growing spread compared to Class A, now at 760 basis points. This widening gap is attributed to rising vacancies in Class B properties.