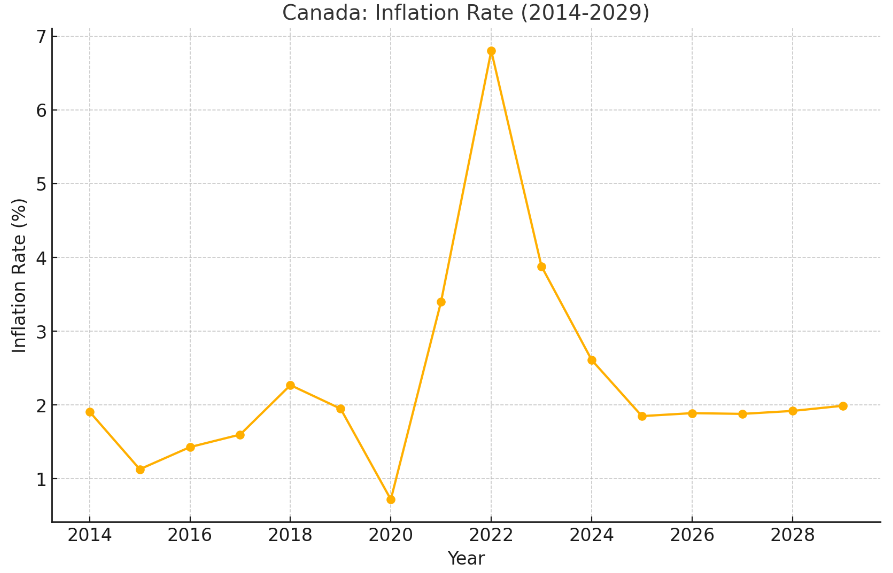

Although Canadian inflation seems to be moderating compared to the spikes seen in 2022 and 2023, it remains elevated relative to historical averages, and it is still an important consideration for investors.

Assets and investments that can hold their value and outpace the cost of living are necessary for growing wealth. Savings and investments that are not at least earning enough to keep up with inflation are effectively shrinking in value, or, at a minimum, not earning as much as they appear to. Real estate stands out as one of the few reliable options in an environment where money in the bank steadily loses its purchasing power.

Unlike many other investments, real estate has the unique advantage of both appreciating over time and generating rental income that can be adjusted with inflation. As prices rise, so too do property values and rents, making real estate a tangible, income-producing hedge against inflation that offers long-term stability and protection against an unpredictable economic landscape.

* 2024 – 2029 – Projected inflation rates only

Source: Statista

Hedge Against Inflation

Its ability to serve as a hedge against inflation is one of the key reasons why real estate is so highly valued for portfolio diversification. As inflation drives the cost of goods and services higher, property values typically increase as well. This protects investors from the diminishing purchasing power of currency, allowing their investments to grow in real terms. Unlike cash or other assets that may lose value during inflationary periods, real estate generally appreciates. This steady growth is especially important in periods of high inflation when other assets may struggle to keep pace with rising prices.

Meanwhile, rental income can increase to compensate for inflation increases, as well. Even with rent increase caps, such as Ontario’s 2025 cap of 2.5% and BC’s 2025 cap of 3%, landlords are able to adjust rates to stay ahead of inflation. Some provinces, like Alberta and Saskatchewan, do not have caps, although increases are limited to once every 12 months.

Stability in Volatile Markets

Real estate also provides a measure of stability during periods of market volatility. While other assets, such as stocks or bonds, may experience sharp declines during economic downturns, real estate tends to be more resilient. Property markets are generally slower to react to economic shifts, giving investors more time to adapt to changing conditions.

This inherent stability makes real estate an attractive option for long-term investors who are seeking to minimize risk. While no investment is entirely without risk, the long-term nature of real estate provides a buffer against short-term market fluctuations. Investors who stay the course and focus on long-term growth are likely to see their wealth grow significantly over time.

Capitalizing on Market Opportunities

For long-term investors, challenging market conditions can offer unique opportunities. Prices may be lower due to temporary market conditions, such as higher or uncertain interest rates, but the long-term outlook remains positive. Investors who take advantage of these lower prices today can benefit from long-term appreciation and rent income.

Investing in underserved areas or emerging markets can provide even greater returns. Areas that are currently undervalued may experience rapid growth as demand increases. Investors who are willing to explore new markets and hold their properties for the long term can capitalize on these opportunities for substantial financial gain.

Hedging against inflation is crucial for any investment portfolio, and real estate remains one of the most effective options. Even in challenging markets, real estate offers unique advantages, adjusting alongside inflation to provide both growth and stability. Unlike other assets that may lose value during inflationary periods, real estate tends to protect investors’ purchasing power. Its long-term resilience allows investors to cope with market volatility and capitalize on emerging opportunities while protecting their wealth.