Canada’s housing starts in June 2025 reveal pronounced regional contrasts and shifting construction patterns that define the current market landscape. While the six-month moving average showed a modest 3.6% increase, the detailed figures expose significant variation in both housing types and geographic areas.

Source: CMHC

Nationally, single-detached housing starts remained relatively stable, with some provinces reporting gains while others, including Ontario, saw declines. Multi-unit starts showed volatility from month to month, complicating short-term supply forecasts and emphasizing the value of trend-based analysis.

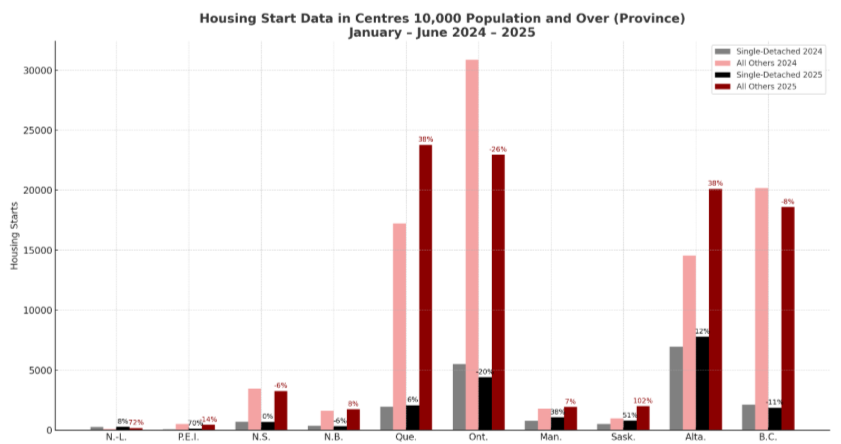

For the period of January to June 2025 compared to the same period in 2024, the strongest growth in housing starts was concentrated in Saskatchewan, Québec, and Alberta. Saskatchewan led with an 84% increase year-over-year, driven largely by new single-detached homes and purpose-built rentals. Québec also showed substantial growth, with a 35% rise in starts, reflecting increased activity outside its largest urban markets. Alberta experienced solid growth as well, with starts up 30%, supported by both single-detached and multi-unit construction.

When looking at total housing starts by volume over the same periods, Alberta ranked highest with nearly 28,000 units started in June, reflecting both its growth and size. Québec followed closely, while Ontario remained a major contributor to Canada’s housing supply despite an overall decline in starts. Ontario’s large population base means its absolute numbers remain significant, even as growth slows. These trends illustrate how expanding construction in smaller and mid-sized markets is helping to offset weaker housing activity in Canada’s largest urban centres.

Source: CMHC

In contrast, the country’s two largest metropolitan markets, Toronto and Vancouver, continue to face steep declines. Although they continue to have the most starts in terms of total volume, they are decreasing compared to the same period in 2024. Toronto’s housing starts dropped 40% year-over-year in June 2025, mainly due to a sharp fall in multi-unit construction, especially condominiums. Vancouver’s total starts fell 11% year-over-year for the period of January to June 2025 compared to the year before, despite a strong monthly rebound driven by multi-unit projects. This ongoing slump in condo development highlights persistent challenges in these key urban markets.

Among cities, for the year to date data as of June 2025,Abbotsford–Mission stands out with a remarkable 130% increase in housing starts, compared to the year before, largely due to a surge in multi-unit projects. Ottawa also showed strong growth at 82%, driven by gains in multi-unit housing. Calgary and Montreal posted more moderate increases.

Overall, Canada’s housing market in June 2025 showed growing activity in the Prairies and Québec, stability in single-detached housing, and continued decreases in major urban condo markets.